One Metric Every Business Owner Should Track

Most business owners monitor at least a few metrics regularly. Their metrics might include financial, sales, operational, employee, or economic metrics – but very few business owners track what we believe is the most critical metric.

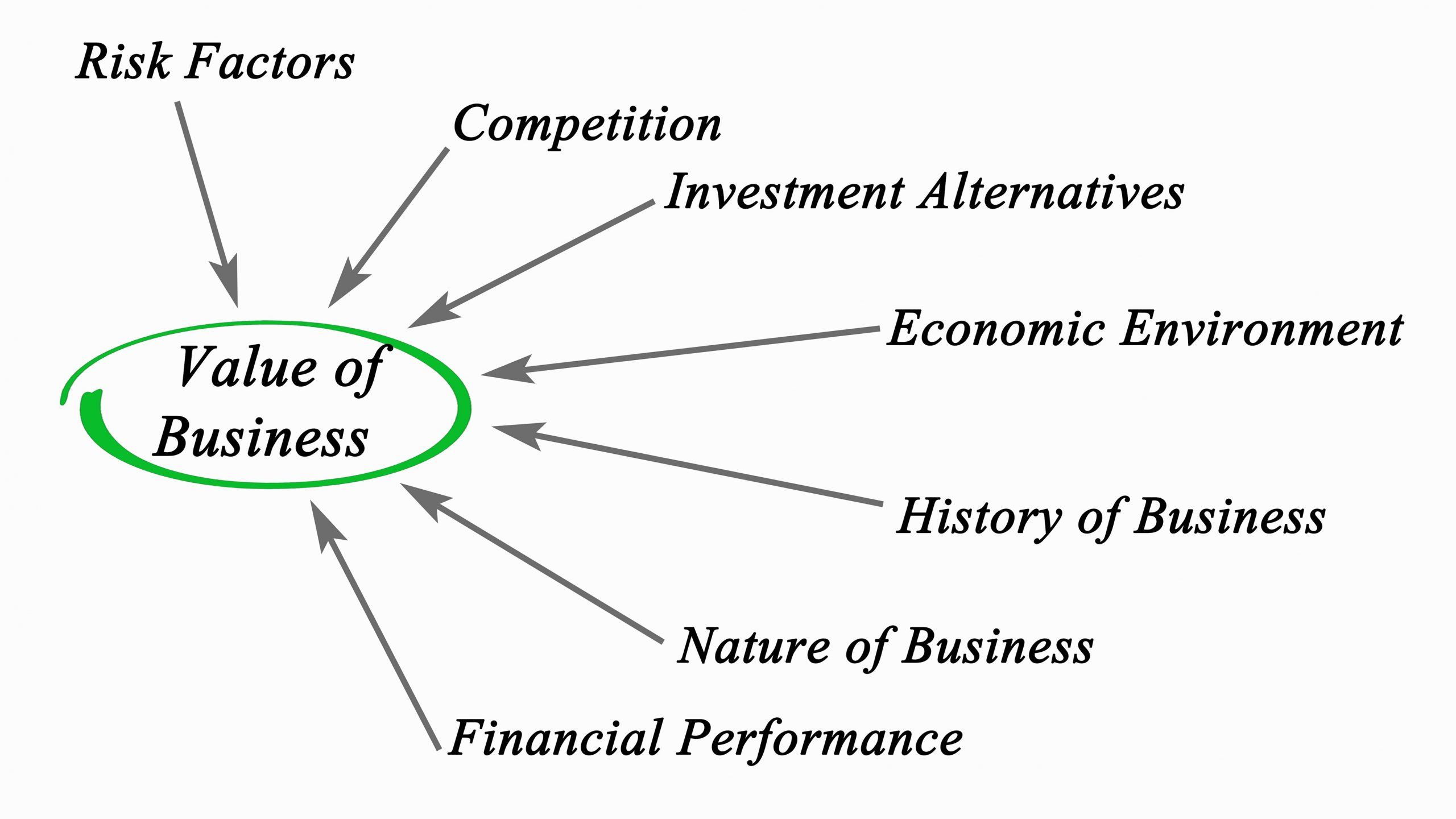

From our experience in helping hundreds of business leaders build successful and sustainable companies, we think the one metric every business owner should track is the company’s market value.

Some business owners believe they know what their business is worth based on what they’ve heard about other companies in their industry or what friends or associates have told them. The reality is that most business owners have an unrealistic understanding of the market value of their companies unless they have had an objective valuation performed by a qualified third-party.

For most business owners, their company represents around 75% of their personal wealth. While they may know what their stocks and house are worth – they usually do not understand what drives the valuation of their most significant asset.

Why Should Business Owners Track the Market Value of Their Company?

Monitor Company’s Health – Just like getting an annual physical at the doctor’s office, a regular valuation provides an effective way to objectively measure company performance. It’s also the best way to identify and prioritize actions to improve performance and increase imarket value. Regular valuations can also provide an early warning for potential problems.

Protect Personal Wealth – Even though their company is their most valuable asset, most business owners don’t focus on maximizing company value until they begin thinking about selling. Waiting until they are thinking about selling is often too late. Even if they never plan to sell, business owners should understand how they can protect and increase their company’s market value.

Knowledge is Power – Knowing what their business is worth can give a business owner an advantage in dealing with lenders or investors if they need capital for an acquisition or other business investment – or if they want to recapitalize their company to pull some equity out of the company.

Prepare for the Future – 100% of business owners with eventually exit their company – and knowing their company’s market value can help them better prepare for when they transition ownership of their company and their family’s financial future.

How Can I Find Out What My Business is Worth?

We recommend that business owners get an independent market valuation of their company every year so they always know what their company is worth. Independent valuations can be expensive, but we have a better option for business owners.

As a strategic partner with Waypoint Private Capital, we help business owners quickly determine the market value of their company – and it’s a free service we provide.

Link HERE if you would like to learn more about our free baseline valuation service.

By Bruce Skaistis